Finances are a topic that just isn’t talked about much in our society. It’s generally considered a very private, personal thing. Even with my good friends – we don’t often have conversations about money. I understand the reasons why, but I also think that being more open to talking about money would benefit our society in general. With all the people drowning in debt or experiencing significant stress because of hidden money woes, I think smart money talk would be helpful.

I specifically think that it’s helpful to me to hear about how families make their finances work. In addition to filling my mind with thoughts of all the neat things I could do or make or buy, I like to see what people don’t do. What kinds of things do families forgo or made-do with so they can live within their means?

Bryan and I have been taking a hard look at our finances, and what we’re seeing shows us that we need to take a new look at our family’s money management. Bryan has a good job. We have nice income flow. We’ve got health insurance. Those are very good things. But for at least the last year or so, our expenses are consistently outstripping our income. It’s a trickle, a steady trickle. And it’s not sustainable.

So over the next days and weeks and months, we’re going to sit down and budget. I’ve budgeted before, but we have always just spent money by feel. Despite all the extensive spreadsheets and accounting systems that I’ve obsessed over in the past, we’ve never actually lived by a pre-determined budget. That’s changing this week.

We use Mint.com to organize our finances. It’s a great (free!) system where you enter all you bank accounts, credit cards, loans, investments, etc. and you can look and track them all in the same place. It also helps you budget and you can compare what you’re spending to what others in different cities and states are spending. It’s been a good tool.

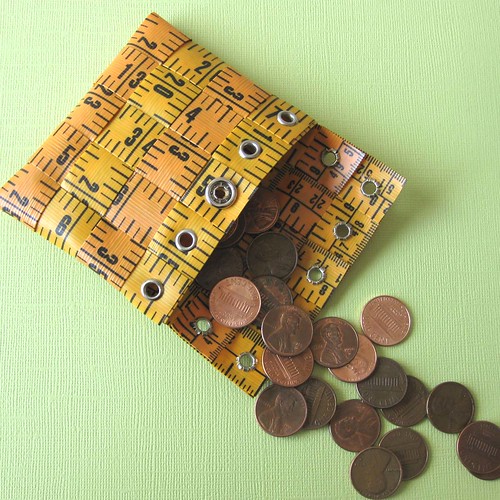

To help us really get a handle on expenses, I’m thinking about using Simple Mom’s envelope system. I never, ever, ever use cash, but if we use this system, we’ll withdraw cash from our bank account at the beginning of the month, put it in envelopes for various expenses, and then we’ll have that as the money we use for the month. Seems like it will certainly help us become more aware of times when we use up our funds in different budget categories!

Simple Mom has a whole section of her website on money management. I don’t subscribe to everything she says, but I do think that she has lots of good ideas. I’d love to stop losing money and to build up a six-month emergency fund.

I’m thinking about writing more about this topic as we move forward. For one, I hope to be encouraging to others who are trying to stay financially soluble, and for two, I’m hoping that some of my readers might have thoughts or suggestions or resources to share. Let me know what you think!

Nikki Haworthat 1:19pm on September 16th

Dave and I just switched our bank- Wisconsin community bank is offering a 4.1% interest rate on checking! You have to meet a few requirements like on-line banking, direct deposit/ auto-pay things like that… but who doesn't love free money?! 🙂 Kind of a pain to move everything over, but it will be worth it.

Deanna Ballewat 7:05pm on September 16th

We'll be jumping on that band wagon too – I'm stoked about them covering ATM fees if I use someone else's ATM!

Julie Buchanan Andersonat 7:07pm on September 16th

We literally write EVERYTHING down that we spend. Jerry then organizes it by month: house payment, utilities, groceries, eating out, kids clothes, etc. It's a great way to see exactly how and what you're spending. Sometimes living on mostly one income seems tricky, but it's so worth it! =)

LuAnn Dotzourat 9:34pm on September 16th

Mark and I used the envelope system for years and years!!. I didn't read the blog to see if it was just what we did, but we used to put the money for each category in twice a month…that way we didn't mess up and spend it all in the first half and then have to scrimp so much the second half. It really works!!

Amy Christianson Goerwitzat 10:30pm on September 16th

Pay yourself first. Each month we have money automatically transferred from our checking account to various savings accounts for things like retirement, home improvement, new car, vacation, even half of our daughter's allowance money (she wants the other half in cash…). If it is not in your checking account then you probably won't spend it.

Althea Babler Dotzourat 10:53pm on September 17th

What a lot of great comments! Wow. I think I've gotten more responses from this post than about anything I've written before. I'm working on the next installment. In the meantime, I copied your comments over to my blog so I could reference them in the future. Thanks for sharing!!

Mark and I used the envelope system for years and years!!. I didn't read the blog to see if it was just what we did, but we used to put the money for each category in twice a month…that way we didn't mess up and spend it all in the first half and then have to scrimp so much the second half. It really works!!

Dave and I just switched our bank- Wisconsin community bank is offering a 4.1% interest rate on checking! You have to meet a few requirements like on-line banking, direct deposit/ auto-pay things like that… but who doesn't love free money?! 🙂 Kind of a pain to move everything over, but it will be worth it.

We'll be jumping on that band wagon too – I'm stoked about them covering ATM fees if I use someone else's ATM!

We literally write EVERYTHING down that we spend. Jerry then organizes it by month: house payment, utilities, groceries, eating out, kids clothes, etc. It's a great way to see exactly how and what you're spending. Sometimes living on mostly one income seems tricky, but it's so worth it! =)

Mark and I used the envelope system for years and years!!. I didn't read the blog to see if it was just what we did, but we used to put the money for each category in twice a month…that way we didn't mess up and spend it all in the first half and then have to scrimp so much the second half. It really works!!

Pay yourself first. Each month we have money automatically transferred from our checking account to various savings accounts for things like retirement, home improvement, new car, vacation, even half of our daughter's allowance money (she wants the other half in cash…). If it is not in your checking account then you probably won't spend it.

What a lot of great comments! Wow. I think I've gotten more responses from this post than about anything I've written before. I'm working on the next installment. In the meantime, I copied your comments over to my blog so I could reference them in the future. Thanks for sharing!!

Michael and I are in the processing of combining assets, which is probably going to be a slow process, but we have had a joint checking and savings account for about a year now in addition to our separate checking and savings. I think that since we have both been single adults for a while, it makes sense to think of our financial life together as a work in progress and I think we will need time to figure out a system that works for us as a couple.

As a single person, I think one of the better things I have done in recent years was change my direct deposit to automatically skim a portion of each paycheck into my savings account. I timed this when I was receiving a raise so that it didn’t really impact my budget. I think this is a really easy way to passively save money, although right now I dip into it for larger expenses more than I would like.

Hi Lisa,

I think it’s so cool that you and Michael are in the process of merging your financial lives. Nice to know that my brother will have you as his partner!

Up until December 2008, we had about five bank accounts, and I had all sorts of automatic withdrawals set up to put money into various savings accounts. When we switched banks, all the money ended up in one account. I wonder if that’s a part of the problem…

I think I should look into setting up savings accounts!

Yeah, hm. I’m more of the “oh, don’t worry, it’ll all work out” philosophy — until we get the overdraft notice from the bank at which point I start mentally berating myself for being such a poor planner.

Daniel & I met when we were 18-year-old college students, and pretty much immediately commingled every aspect of our lives. I’ve never had a separate checking account, and all of our credit cards are in both our names.

As far as the things we do without, there aren’t any conscious decisions to forego something, it’s just more that we never realize that we COULD have it. We’ve always lived hand to mouth, so we’ve always made do with what we had, rather than longing for something else. We don’t do cable, we don’t even really do appliances! Shara wanted a hair dryer, and it was the first time I’d ever bought one.

Hi Karen,

I’m so glad you replied. And it’s funny comparing your response to Betsy’s below. I like knowing that you and Daniel have been able to navigate your way through life with a hand-to-mouth, “don’t worry, it’ll work out” approach.

You’re a good friend in many ways, Karen, and one of them is demonstrating to me the wonderful lives and times of the Bassler-Mortensons.

Like your friend above, Josh and I married young and combined finances young. We had such a limited income, I started budgeting at age 19 with paper and pencil. It has slowly evolved from a paper budget to an excel spreadsheet. It’s currently has a method similar to the envelop method- I have categories like groceries, utilities, gas, entertainment, fun shopping, car repairs, medical bills, eating out, entertainment, pets (like food, treats, and vet bills), gifts, and stuff for the house. Each category is allotted a monthly amount. If used up, I can’t use any further money from the category without shifting from another category. Some categories are meant to roll-over like car, pets, and house. Those costs are consistent throughout the year and need to accumulate for months I need them. Mint.com finally added this feature recently (I used my excel spreadsheet and Mint.com due to Mint.com’s limitations). These categories are only for discretionary spending. I input my spending into each category from receipts, bank statements, or credit card statements as the month goes by.

I know how much I can afford in each category because each month of the year has its own workbook for me to track income and fixed expenses like the mortgage and utilities. After allocating funds to the nest egg, I can budget the remainder for the above categories.

I also use a weekly cash flow spreadsheet. It monitors when the income comes in and when expenses must come out. It helps me guarantee that I never bounce a check or ACH transaction. While I know I may be able to afford the purchase in the long run because my monthly budget still balances, doesn’t mean I can afford it at this particular time. It really helps me to see the effect of a purchase I would like to make or if I can afford something like a car payment. The weekly cash flow can be shown through a whole year. If I ever have a negative balance at the end of any week, I know I will have to shift a bill over, pull money from the savings account to cover the deficit, or cut my spending to make the spreadsheet balance.

I hope the envelop method works for you. I am terrified that I would lose one of the envelops (I would end up doing that). Have you addressed the issue if you have the envelops and Bryan has to make a purchase and ends up using the debit card or credit card? Somehow the money has to get reimbursed to the appropriate account.

I have some sample spreadsheets that I have created for clients. If anyone ever wants a copy, let me know. I can email them to you.

Budgeting can seem like a hassle, but it has become one of my favorite tasks! That and doing taxes…

Wow! Betsy, thanks for responding in such detail. And I thought I was a planner. Holy cow!

I’d love to see your Excel spreadsheets if you’d like to send them to me.

Thanks again!

What a lot of great comments! Wow. I think I've gotten more responses from this post than about anything I've written before. I'm working on the next installment. In the meantime, I copied your comments over to my blog so I could reference them in the future. Thanks for sharing!!

Mitch said something wise recently when we were discussing budgeting. I was wringing my hands about something and he said something along the lines of budgeting not being simply about limitations, but that in allocating a certain amount of money in various fields you have money to spend on those various fields. Genius. I knew there was a reason I married that guy. I think budgeting can be very freeing in doing away with the vague sense of unease that doing without a budget can foster.

Hi Jessica,

Thanks to you and to Mitch for the great perspective. And thanks for being a good friend to talk about so many things, including finances! I’m glad I have you:)

Dave and I just switched our bank- Wisconsin community bank is offering a 4.1% interest rate on checking! You have to meet a few requirements like on-line banking, direct deposit/ auto-pay things like that… but who doesn’t love free money?! 🙂 Kind of a pain to move everything over, but it will be worth it.

Bryan and I moved our accounts to Charles Schwab online bank last December for a 4% interest rate. Unfortunately, it’s dropped a lot since then.

Urgh. It was such a hassle to change all of our automatic payments and direct deposits, etc.

But, 4% is good! At last at Schwab we get ATMs covered too!

Given all the bank collapses recently, I’m glad we’ve stuck with Heartland CU. I’m such a fan of all things cooperative and non-profit.

All this discussion makes me ever more aware of my inability to think in terms of a “bottom line.” I am just not at all motivated by money. Sure, I’d love to travel to Europe and I would really like another toilet in our house, but neither are encouragement enough to make me pay attention to finances, or to seek out higher paying employment (ha!). I could never survive in an environment where my role was to ensure profits for my company – oh wait, that’s what I *should* be doing with my business, huh?

Hi Karen,

You make me laugh. Thanks for sharing your non-financial motivation:)

We’ll be jumping on that band wagon too – I’m stoked about them covering ATM fees if I use someone else’s ATM!

We literally write EVERYTHING down that we spend. Jerry then organizes it by month: house payment, utilities, groceries, eating out, kids clothes, etc. It’s a great way to see exactly how and what you’re spending. Sometimes living on mostly one income seems tricky, but it’s so worth it! =)

I really like things electronic. I love how Mint.com is able to aggregate and categorize all our expenses from all our credit cards.

But I think I’ll try to cash system and keep receipts and write it all down. Now if I had an iPhone… Just kidding!

My cousin Katherine found iPhones for ultra cheap on eBay…

Mark and I used the envelope system for years and years!!. I didn’t read the blog to see if it was just what we did, but we used to put the money for each category in twice a month…that way we didn’t mess up and spend it all in the first half and then have to scrimp so much the second half. It really works!!

I’ve heard you talk about the envelope system in the past. Seems like it worked pretty well for you, and I like the idea of breaking the month in half so you don’t spend everything the first couple weeks! Thanks for sharing so many good ideas with us:)

Pay yourself first. Each month we have money automatically transferred from our checking account to various savings accounts for things like retirement, home improvement, new car, vacation, even half of our daughter’s allowance money (she wants the other half in cash…). If it is not in your checking account then you probably won’t spend it.

I used to do this. You’ve helped remind me that I need to set up savings accounts! I’ll download the forms right now!